Sourcing Chinese TiO2: A Comprehensive Guide to Chloride vs. Sulfate Processes and Top Grades

Blue-phase brightness or cost-effective opacity? Choosing the right Chinese TiO2 depends entirely on the manufacturing process. We analyze the performance gap between Chloride and Sulfate technologies and list the top Chinese grades that are challenging global standards. Essential reading for procurement and R&D leaders looking to optimize their supply chain.

The Chinese Titanium Dioxide (TiO2) industry is currently undergoing a massive shift, moving from a focus on “quantity” to “quality.” For international procurement managers and R&D chemists, navigating the landscape of Chinese brands can be complex.

Choosing the right grade depends entirely on the manufacturing process—Chloride or Sulfate—and the specific finish required. This guide breaks down the characteristics, applications, and top-tier grades from China’s leading manufacturers.

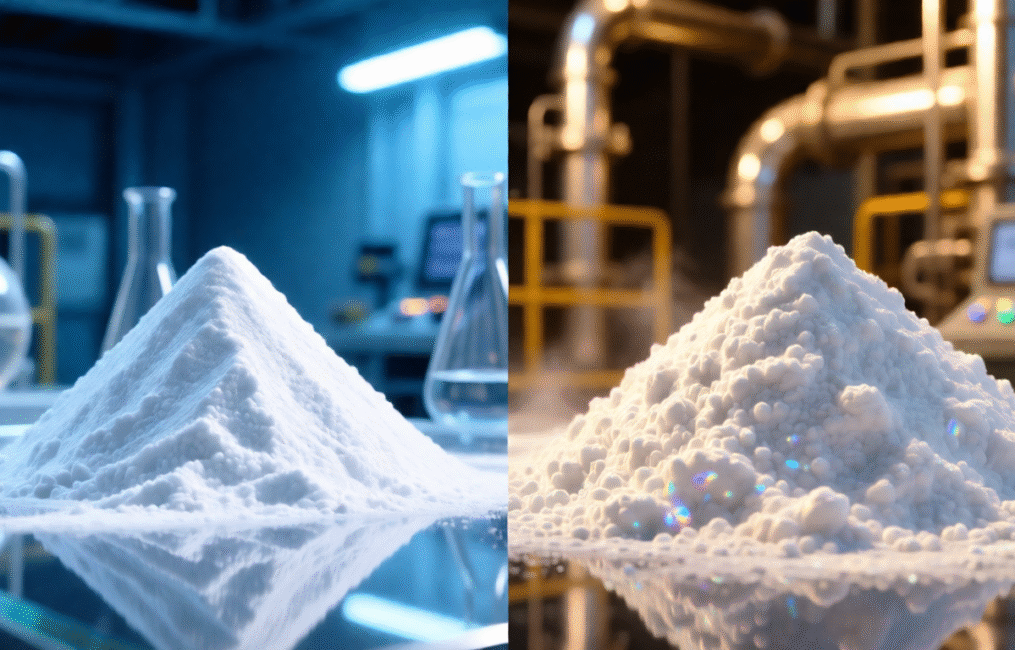

1. The Chloride Process: The High-End “Blue” Standard

The Benchmark for Performance

The Chloride process is the cutting-edge standard in the industry (pioneered globally by companies like Chemours). In China, LB Group (Lomon Billions) is the absolute leader in this space, with other players like CITIC Titanium and Pangang Vanadium Titanium growing their capacity.

Key Characteristics:

- Whiteness & Undertone: Produces a distinct blue undertone. This makes finished products look cleaner, brighter, and visually “whiter” compared to sulfate grades.

- Purity: The distillation process removes heavy metals (like iron), resulting in exceptionally low impurity levels.

- Dispersion: Very narrow particle size distribution means it disperses easily in resins, requiring less energy to grind.

- Weather Resistance: Generally superior to sulfate grades, making it ideal for long-term outdoor exposure.

Ideal Applications:

- Automotive OEM and Refinish coatings.

- High-end exterior architectural paints.

- Premium plastics (PVC profiles, appliances) where yellowing is unacceptable.

- High-quality printing inks.

Top Chinese Grades to Watch:

- LB Group:

- BLR-895: The flagship coatings grade. designed to compete with international standards (like R-902+) offering excellent opacity and weatherability.

- BLR-886: A plastics specialist with a very blue undertone and excellent melt flow.

- BLR-896: Super-durable grade for industrial coatings exposed to harsh environments.

- CITIC Titanium (formerly Jinzhou):

- CR-510: High gloss and weather resistance for coatings and inks.

- Pangang Vanadium Titanium:

- CR-350: Specialized for plastics with excellent anti-yellowing properties.

2. The Sulfate Process (Rutile): The Market Workhorse

The Balance of Performance and Cost

This is the most mature technology in China. While the process is older, advanced surface treatment (coating) technologies allow these grades to perform very close to chloride grades in many applications.

Key Characteristics:

- Cost-Effectiveness: Typically $150–$450/ton cheaper than chloride grades.

- Hiding Power: The Rutile crystal structure offers a high refractive index, providing excellent coverage.

- Versatility: Manufacturers use various inorganic (Zirconium, Aluminum, Silicon) and organic treatments to create hundreds of specialized grades.

- Undertone: Slightly yellower than chloride grades (often undetectable to the naked eye but measurable by instruments).

Ideal Applications:

- Architectural interior and exterior paints (used by majors like Nippon Paint/Dulux).

- Industrial anti-corrosion paints.

- Masterbatches, pipes, and profiles.

- Decorative paper laminates.

Top Chinese Grades to Watch:

- LB Group:

- R-996: The “Industry Standard.” This is the most widely circulated grade in China. It is a universal workhorse for both coatings and plastics.

- Dongjia Group:

- SR-2377: A star performer in coatings and color pastes, known for low oil absorption and high gloss.

- CNNC Hua Yuan:

- R-219: Excellent for water-based coatings with great dispersion.

- R-215: A universal grade for plastics and coatings.

- Blue Star (Jinan Yuxing):

- R-818: A highly recognized universal grade.

3. The Sulfate Process (Anatase): The Economic Entry

For Indoor and Special Applications

In the sulfate process, if the calcination temperature is kept lower and no crystal conversion occurs, the result is Anatase TiO2.

Key Characteristics:

- Whiteness: Often whiter than Rutile due to crystal structure.

- Softness: Lower hardness causes less wear on manufacturing equipment.

- The “Fatal Flaw” (Weatherability): It has high photo-activity. If used outdoors, UV light will cause it to chalk (powder) rapidly. Strictly for indoor use.

- Lower Hiding Power: Lower refractive index requires a higher loading volume to cover the background color.

Ideal Applications:

- Paper manufacturing.

- Internal wall coatings (economy grade).

- Fiber delustering (reducing shine in synthetic fabrics).

- Ceramics and Enamel.

Common Grades:

Brands usually denote these with an ‘A’. Differences between brands are less pronounced than in Rutile.

- LB Group: A-101 / MCA120

- CNNC: A-100

- Nanjing Titanium: NA-100

Technical Deep Dive: Why is there no “Chloride Anatase”?

You might notice a pattern: Chloride grades are always Rutile. Why?

It comes down to Thermodynamics and Economics.

- Temperature Defines Structure: The core of the Chloride process is the oxidation of Titanium Tetrachloride (TiCl4) at extremely high temperatures (1200℃ – 1500℃). At this heat, the metastable Anatase structure cannot exist; it spontaneously rearranges into the thermodynamically stable Rutile structure.

- The Sulfate Advantage: The Sulfate process finishes with a calcination step at lower temperatures (800-900℃). This allows manufacturers to “choose” their crystal form by adjusting heat and adding seed crystals.

- The Economic Paradox: The Chloride process is expensive and technical. Anatase is an economic product. Even if you could force the Chloride process to make Anatase (by lowering temps, which ruins efficiency), it would make no business sense to use the world’s most expensive process to make the cheapest commodity product.

Conclusion

For “Blue-phase” whiteness and top-tier durability in automotive or high-end plastics, Chloride (LB Group BLR series) is the go-to. For the vast majority of architectural and industrial applications where cost and performance must balance, Sulfate Rutile (like the R-996) remains the smart choice.

Are you currently sourcing TiO2 from China? Which grades have you found most effective for your applications? Let’s discuss in the comments.