2024: Insights into China’s Epoxy Resin Industry and Global Trade Trends

China’s epoxy resin industry is thriving, with a 2024 production capacity of 3.34 million tons. Despite export growth and rising demand in composites, overcapacity and shrinking profits challenge the sector. Discover how global trade dynamics, anti-dumping investigations, and raw material trends shape this vital industry’s future on our blog. Explore the details now!

2024 Overview and Trade Dynamics of China’s Epoxy Resin Industry

General Industry Overview

- Production Capacity: In 2024, China’s total epoxy resin production capacity reached approximately 3.34 million tons/year, a year-on-year increase of 4.5%. The industry’s top five producers (CR5) accounted for about 50% of the market. The country’s epoxy resin output reached 1.76 million tons, a year-on-year growth of 15%. However, due to structural overcapacity, many factories operated at low utilization rates or shut down to reduce inventory pressures. The current industry operating rate has fallen to a multi-year low of only 53%. Domestically produced epoxy resin products mainly focus on general-grade products, with an imbalanced product structure that cannot fully replace imports.

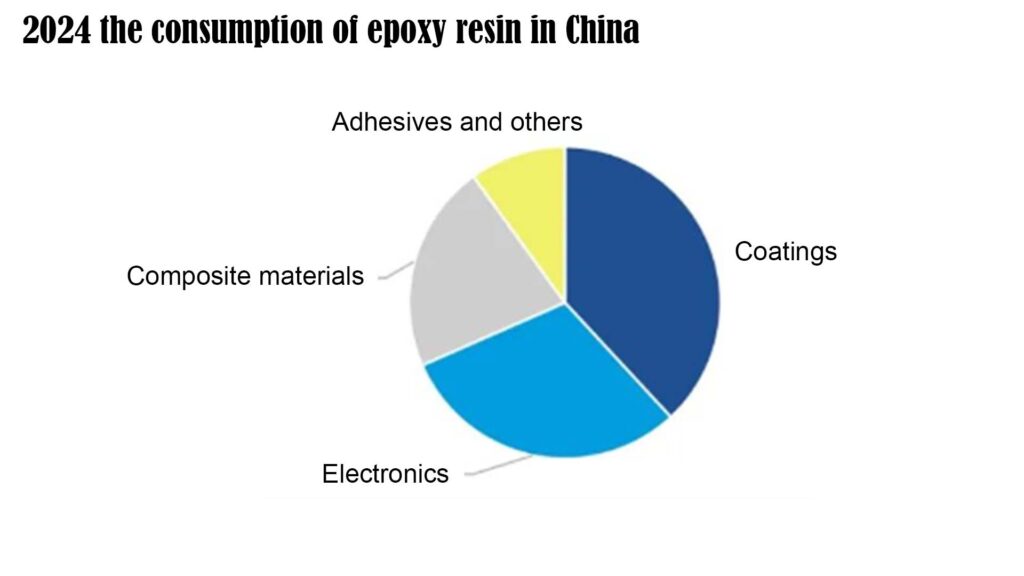

- Consumption and Market Size: In 2024, China’s epoxy resin consumption reached 1.64 million tons, a year-on-year increase of approximately 8%, with a market size of around 25 billion yuan. Key downstream consumption areas include coatings, electronics, composite materials, adhesives, and others. The coatings industry is the largest consumer, followed by electronics, while the composite materials sector experienced the fastest growth in epoxy resin consumption. Adhesives and other fields account for approximately 10% of consumption.

Import and Export Trends:

With improved domestic supply capacity and declining prices, imports have decreased, and exports have steadily grown. It is estimated that imports will total approximately 140,000 tons in 2024, while exports will reach 260,000 tons. Russia significantly increased its imports of epoxy resin from China, becoming a major driver of export growth.

- International Trade Restrictions:

- The United States, the EU, and India initiated anti-dumping investigations or sanctions against Chinese epoxy resin in 2024, which may affect exports.

- U.S. Actions: In November 2024, the U.S. Department of Commerce issued a preliminary anti-dumping ruling on epoxy resin imports from China, India, South Korea, Thailand, and Taiwan. Chinese producers faced a dumping margin of 354.99%, reduced to 344.5% after offsetting subsidies. However, since the U.S. accounts for a small share of China’s epoxy resin exports, the overall impact is expected to be limited.

- EU Actions: In July 2024, the European Commission launched an anti-dumping investigation into epoxy resin imports from China, South Korea, Taiwan, and Thailand. As Europe is a major export destination, any anti-dumping duties could significantly affect Chinese exports.

- India’s Actions: In July 2024, India’s Ministry of Commerce and Industry initiated an anti-dumping investigation on liquid epoxy resin imports from China, South Korea, Saudi Arabia, Thailand, and Taiwan.

Market Analysis

- Price and Profit Trends:Despite growth in consumption and exports, the industry remains in oversupply. Intense market competition has led to shrinking profit margins. Since September 2024, resin prices have fallen below production costs, exacerbating industry losses.

- 2024 Pricing:

- Liquid epoxy resin (E-51) in East China averaged 13,632 yuan/ton, down 7.2% year-on-year.

- Solid epoxy resin (E-12) averaged 12,825 yuan/ton, down 5.6% year-on-year.

- 2024 Pricing:

- 2025 Outlook:

- Supply: Four new or expanded production facilities are expected to start in 2025, raising capacity to 3.74 million tons/year. Oversupply will persist, keeping prices low and forcing the closure of older, less competitive facilities.

- Demand: Driven by wind energy, composite materials demand is expected to grow rapidly.

- Wind power capacity additions are projected to increase by 10%, and photovoltaic installations by over 20%.

- In the coatings and electronics sectors, gradual recovery is anticipated, influenced by macroeconomic trends and downstream demand for AI, consumer electronics, and servers.

- Epoxy resin consumption is forecasted to grow by about 6% in 2025.

- Raw Material Costs:

- Epichlorohydrin (ECH): Prices may rise slightly in 2025 due to higher glycerol feedstock costs, supporting production costs.

- Bisphenol A: Prices are expected to remain low due to ample supply.

Conclusion

China’s epoxy resin industry faces structural overcapacity, with persistent low prices expected until supply-demand imbalances are resolved. Despite growth in consumption and exports, profitability remains under pressure.